by jason | Nov 5, 2022 | IRS, Tax Tips, Uncategorized

When you owe back taxes and can’t afford to make any payments, then it may be time for a special tax status known as currently not collectible. This means that your debt is still considered valid even though there is no chance at recovery right now. When you’re...

by Elizabeth Holladay | Oct 10, 2022 | IRS, Tax Tips

You open up the mailbox, expecting the usual mix of bills and catalogs, but what you find is a collection letter from the IRS. It can feel like you are living in a nightmare that you can’t wake up from when you receive a collection letter from the IRS. Even worse,...

by jason | Oct 7, 2022 | IRS, Tax Tips

Working with the IRS has never been easy, and tax settlement agreements are always complicated affairs. If you are currently working to pay off your tax debt, you may wonder what the recently passed ‘Inflation Reduction Act of 2022’ has in store for you....

by Elizabeth Holladay | Aug 31, 2022 | Business, IRS, Tax Tips

Dealing with tax issues can often be a challenge and feel overwhelming for many people. Choosing to work with a tax resolution professional is often an excellent choice if you are dealing with the IRS. These tax relief specialists can guide you throughout the entire...

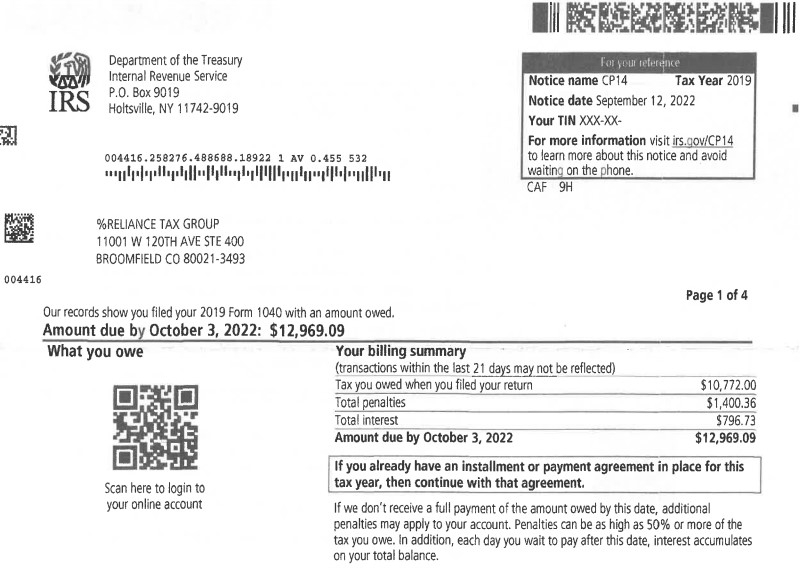

by jason | Aug 24, 2022 | IRS, Tax Tips, Updates

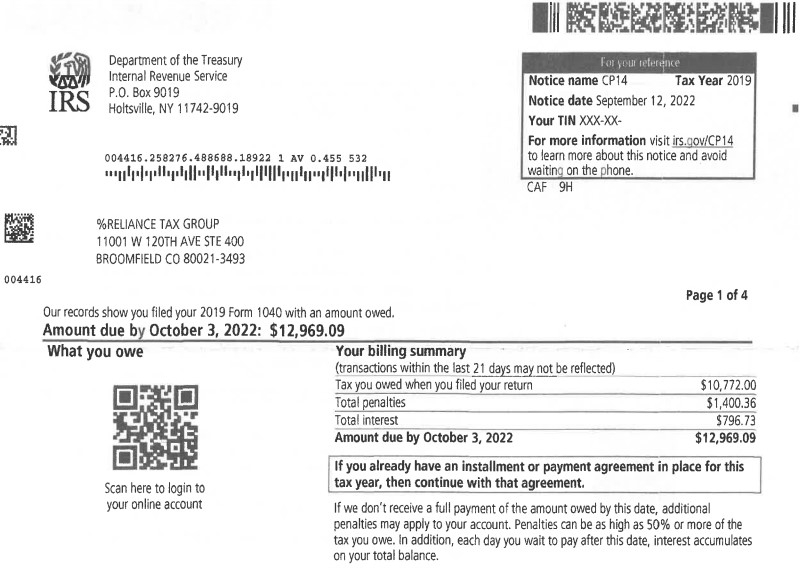

The IRS has authorized widespread AUTOMATIC penalty relief for certain 2019 and 2020 tax returns due to the pandemic resulting in $1.2 billion in penalties being refunded to 1.6 million taxpayers! To help struggling taxpayers affected by the COVID-19 pandemic, the IRS...

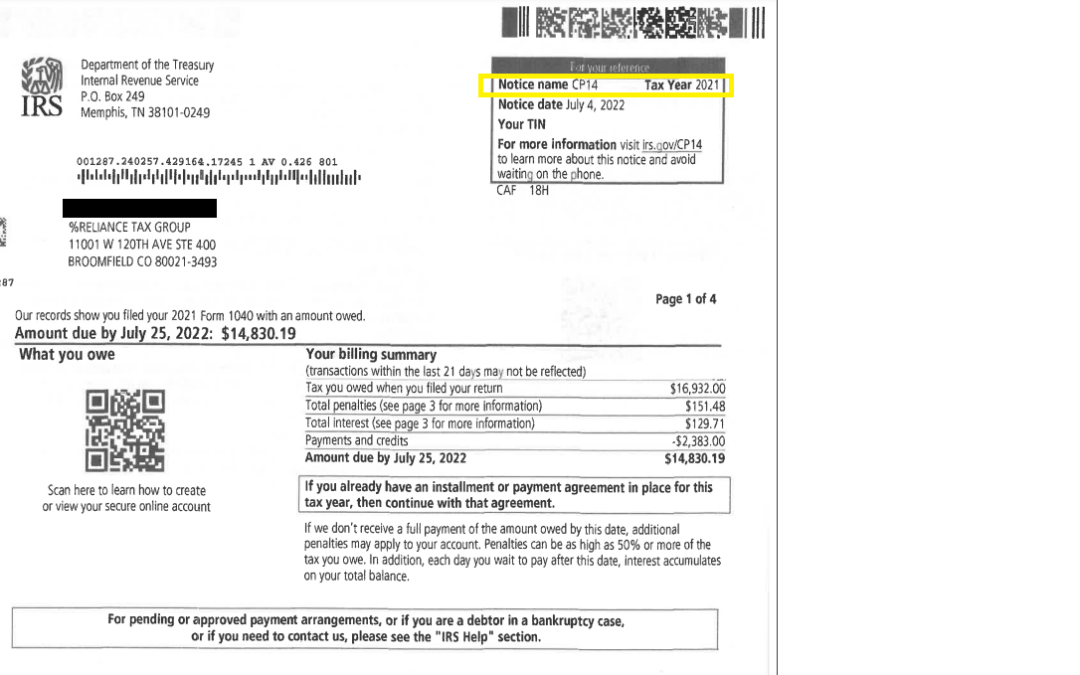

by Elizabeth Holladay | Jul 29, 2022 | IRS

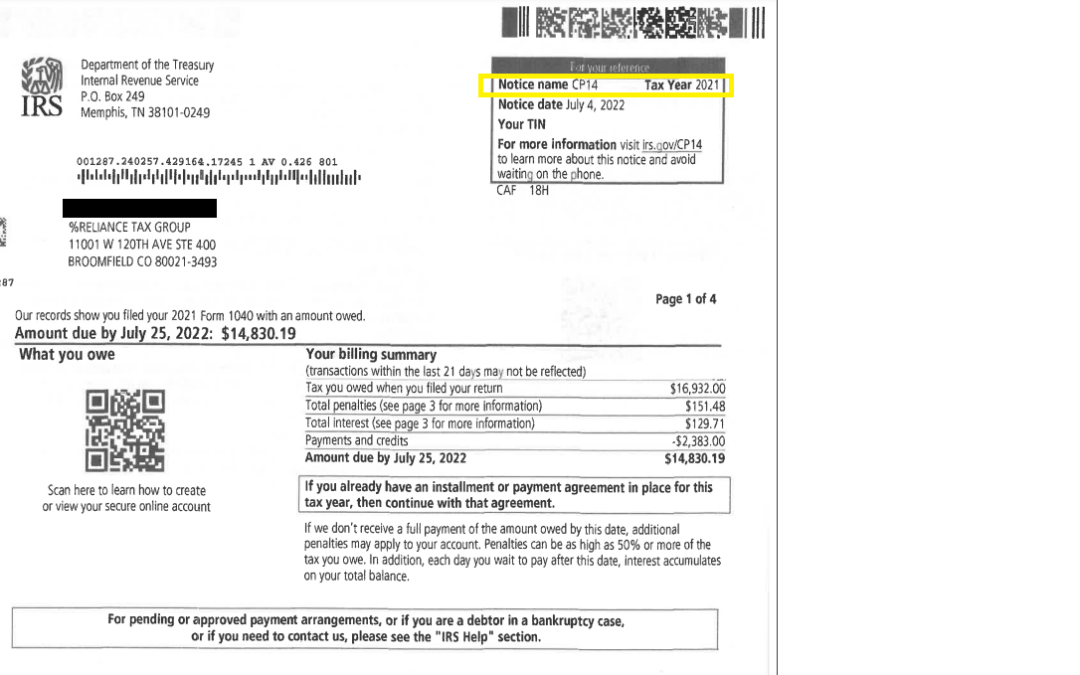

On July 27, 2022, The IRS issued a statement regarding erroneous tax due notices that have been sent to thousands of taxpayers. The statement is as follows: The IRS is aware that some payments made for 2021 tax returns have not been correctly applied to joint taxpayer...