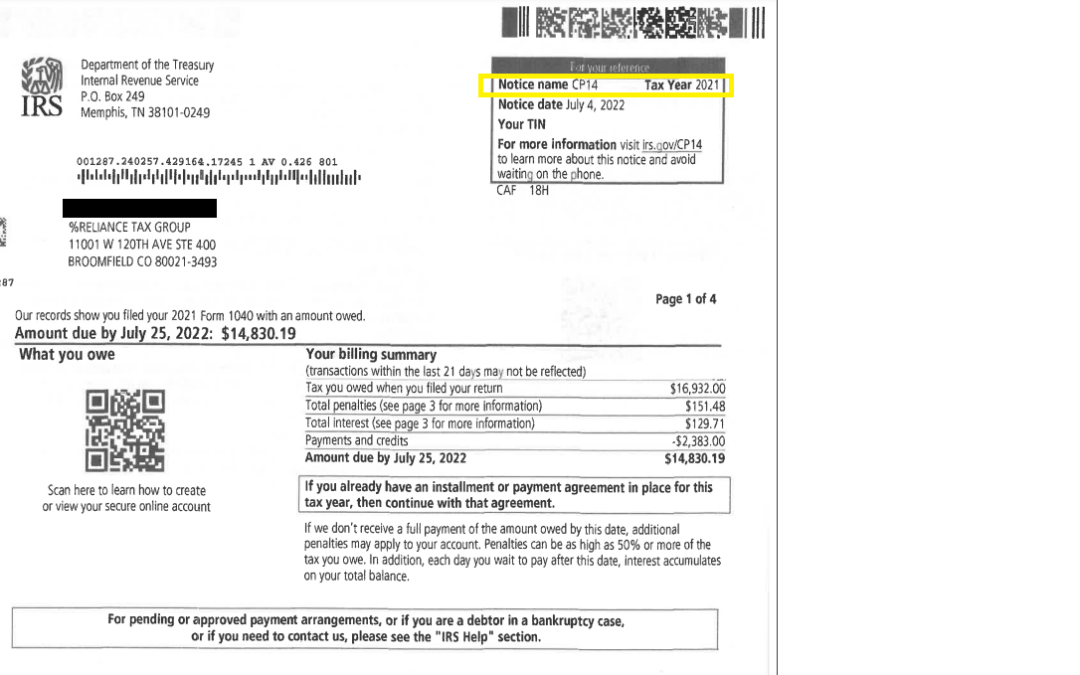

On July 27, 2022, The IRS issued a statement regarding erroneous tax due notices that have been sent to thousands of taxpayers. The statement is as follows:

The IRS is aware that some payments made for 2021 tax returns have not been correctly applied to joint taxpayer accounts, and these taxpayers are receiving erroneous balance due notices (CP-14 notices) or notices showing the incorrect amount.

Who is affected: Generally, these are payments made by the spouse (second taxpayer listed) on a married filing jointly return submitted through their Online Account. Some other taxpayers may also be affected outside of this group.

No immediate action or phone call needed: Taxpayers who receive a notice but paid the tax they owed in full and on time, electronically or by check, should not respond to the notice at this time. The IRS is researching the matter and will provide an update as soon as possible. Taxpayers who paid only part of the tax reported due on their 2021 joint return, should pay the remaining balance or follow instructions on the notice to enter into an installment agreement or request additional collection alternatives. Taxpayers can ensure that their payment is on their account by checking Online Account under the SSN that made the payment. Note that any assessed penalties and interest will be automatically adjusted when the payment(s) are applied correctly.”

If you received a notice and have questions, CONTACT US or call 720-452-2915

What is a CP14?

What to do:

If you receive a CP14, first verify whether you already paid the tax due. If you already paid the tax as shown on your return, no action is needed and wait for the IRS to correct your account.

If you did NOT pay the balance as shown on your return and you don’t have the ability to pay it, CONTACT US or call 720-452-2915 for guidance on how we can help resolve your tax balance!