Tax Tips

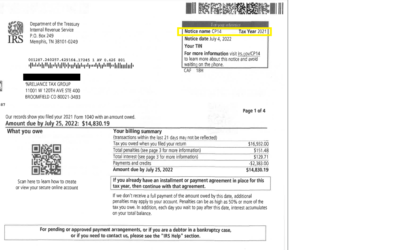

On The BlogIRS Sends Erroneous Bills (CP14)

On July 27, 2022, The IRS issued a statement regarding erroneous tax due notices that have been sent to thousands of taxpayers. The statement is as follows: The IRS is aware that some payments made for 2021 tax returns have not been correctly applied to joint taxpayer...

Small Business Owner: Owe Payroll Taxes? Here’s What to Do

Unpaid payroll taxes are a serious matter to the IRS and are some of the worst kinds of back taxes you can owe. If you’re a small business owner with a payroll tax problem, read on to learn what you can do to avoid the IRS crippling your business or worse, shut your...

Avoid the April 18th Blues- Take a Step-by-Step Approach to Your Taxes

It is no wonder so many Americans dread the April 15 tax filing deadline. The U.S. tax code already contains more words than the Bible, and hundreds of pages of new rules and regulations are often added. With so much complexity, it is no wonder so many of us put off...

IRS Notices

I got an IRS notice... what does it mean? https://www.youtube.com/watch?v=AeSELq_bWs8

Tax Season is Over, What Now?

Tax season is officially coming to an end, but many people are still dealing with tax debt and the IRS. You already know here at Reliance Tax Group, our priority is making sure you’re prepared. If you owe money to the IRS, we can help negotiate on your behalf! For...

Which Type of Installment Agreement is Right For You?

Did you know that if your total tax burden is greater than $50,000 personally you’re required to fill out a financial statement to help determine how much you have to pay per month? The IRS has several Collections Information Statements to pick from and choosing which...