by jason | Nov 2, 2017 | IRS, Tax Tips

An Offer in Compromise (OIC) is an agreement made with the IRS that settles your tax debt for less than the full amount you owe. An OIC can be a powerful way to reduce your tax debt to something you can manage. Offering an acceptable offer in compromise requires loads...

by jason | Oct 13, 2017 | IRS, Tax Tips

A large number of married taxpayers file a joint tax return in order to reap certain benefits allowable under this filing status. It is important to remember, however, that when filing a joint return, both taxpayers are liable for the taxes owed under federal law. The...

by jason | Sep 22, 2017 | Business, Companies, IRS, Tax Tips

You are certain your taxes were paid in full. Then why is the IRS claiming you owe more? The majority of taxpayers who receive tax error notices from the IRS just shake their heads and pay the amount claimed to be in error. But consider this: most IRS notices are...

by jason | Sep 19, 2017 | Business, Companies, Industry, IRS, Tax Tips

Tax firms abound. Perform a Google search for ‘tax specialists’ near you and view the results. Likely you will see taglines on many of those search results that proclaim “We can settle your IRS tax debt for pennies on the dollar” or some such impossible notion. Any...

by jason | Sep 15, 2017 | Business, Companies, IRS, Tax Tips

If you have entered into an installment agreement with the IRS to pay overdue taxes, your obligations are simple. Make your installment payments on time, file current tax returns on time, and pay your current taxes on time. Did you notice a key phrase? ‘On time.’ When...

by jason | Sep 14, 2017 | Business, Companies, IRS, Tax Tips

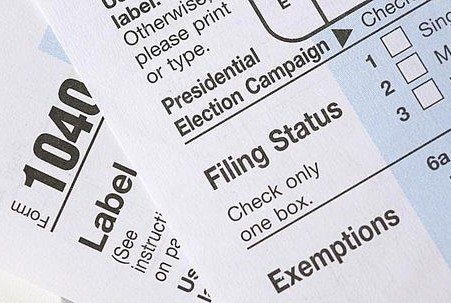

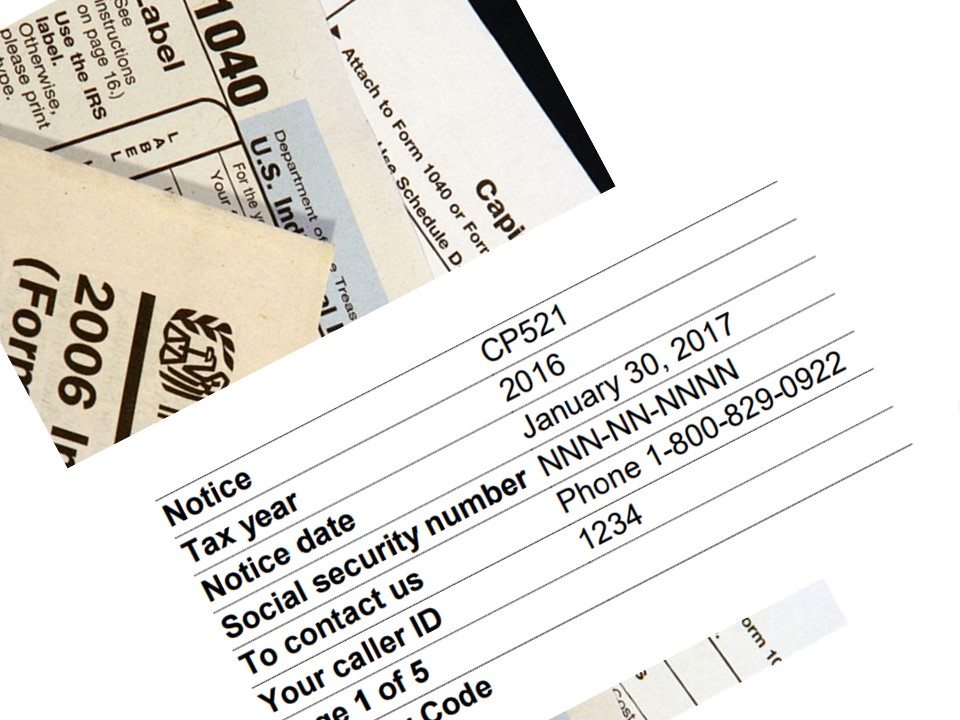

If you have established an installment agreement with the IRS to eliminate outstanding tax debt, you may receive an occasional CP-521 Notice. This notice is a reminder that a payment is due, and will state the due date and remaining balance on your account. In...