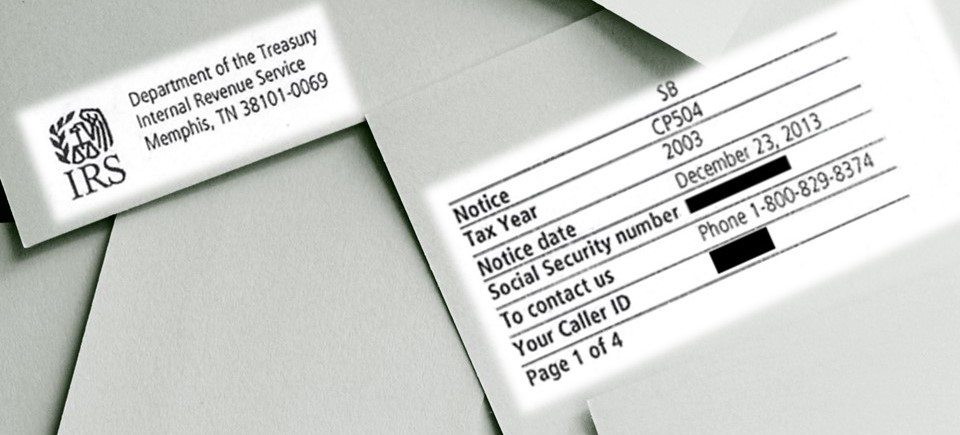

For any number of reasons, many people find themselves falling behind and owing the IRS for previous year’s taxes. Fortunately, the IRS will send a veritable barrage of official written notices to remind you about your outstanding balance. CP-501, CP-503, and CP-504 Notices are sent in succession over an approximate six month period. If you have received one or more of these notices, you may be wondering about your next course of action. Let’s look at each and what they mean for you.

Computer Paragraph 500 Series Notices

- CP-501 – This is the first letter you will receive from the IRS concerning your outstanding tax debt. It is normally worded in a non-threatening manner and simply reminds you of your account with a balance due. It will state the amount owed, including additional interest and penalties that will accrue.

- CP-503 – The next letter you receive will be somewhat firm, normally demanding action within the next ten days. This notice will also mention for the first time how the IRS can initiate action against you to secure payment of your outstanding tax debt. A federal tax lien will likely be mentioned in this letter, as well as the amount now due including an increasing amount of interest and penalties.

- CP-504 – This is the final written notice in this series of letters before official action will be taken against you. It is worded strongly, communicating in absolute terms the IRS’ intention to obtain a lien against your personal and business assets, with the intention of seizing them. The amount owed, including current accrued interest and penalties, is clearly stated. This is your final chance to respond before the IRS takes action against you.

What Happens Next?

If the outstanding tax debt is not paid, or payment arrangements secured, the IRS will file a Notice of Federal Tax Lien on any and all property you own and in which you hold an interest. When a lien is in place, it will be almost impossible to sell or borrow against your assets. Your credit report will be severely affected, and your creditors will be notified of the IRS’ intention to seize your property.

After a four to six month process, the IRS will initiate collections proceedings. The length of time this will take depends on the type and amount of taxes you owe, and if you have had previous tax problems with the IRS. If you haven’t filed a return or owe a substantial amount, the IRS can even skip all notices after CP-501 and issue an Intent to Levy notice immediately.

Property that can be seized in order to pay your outstanding tax debt includes, but is not limited to, the following:

- State income tax refunds

- Bank accounts

- Wages, commissions, and other income

- Personal assets (including car, home, and other real estate)

- Business assets (including property and accounts payable)

- Social Security Benefits

How Should I Respond?

It is easy to become aggravated and simply ignore the growing number of written notices concerning your tax problems. This is, however, the worse possible course of action. If your tax debt continues to go unpaid, the situation escalates and the IRS will resort to increasingly drastic tactics in order to collect what is due.

Reliance Tax Group has plenty of experience successfully guiding our clients through the intricate maneuvers of negotiating with the IRS. We are a flat fee company, so there are no surplus hours or hidden fees to complicate your financial troubles. If you have received any of the above notices from the IRS, call us at (720) 452-2915 or contact us online to set up your free consultation. Don’t wait until things escalate – contact us today!